- Home

- /

- News

- /

- Focus on bonds convertible into shares

Focus on bonds convertible into shares

Bonds convertible into shares (obligations convertibles en actions (OCA)) belong to the legal category of securities giving access to the capital (valeurs mobilières composées donnant accès au capital (VMDAC)): they are composed of a primary security, a bond (fixed-income debt security), which may give the right – upon conversion – to one or more shares of the issuing company (secondary equity securities).

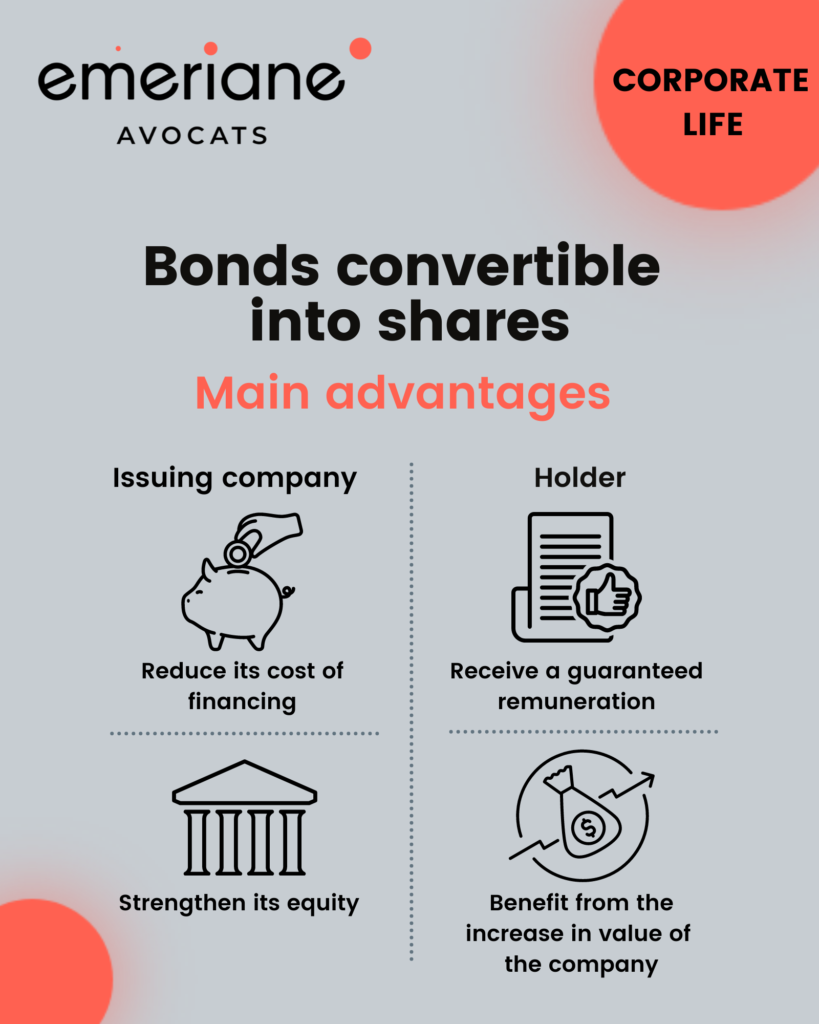

The use of bonds convertible into shares has increased significantly in recent years as this financial instrument offers a number of advantages both for the issuing company and for its subscribers. Nevertheless, certain risks must also be taken into account by each of these two parties.

I. What is a bond convertible into shares?

• The primary security: the bond

Bonds convertible into shares are first of all bonds governed by articles L. 228-38 et seq. of the French Commercial Code: they are negotiable securities issued by a joint stock company which are all issued at once at the same par value and confer the same rights. The company issuing them borrows money from investors who subscribe to the bonds issued (it is a loan of money for the latter).

• The secondary security: the stock

In addition, bonds convertible into shares give their holders the right to convert the bonds into shares of the issuing company according to a conversion ratio and at certain times set out in the issuance contract. As securities giving access to the capital, bonds convertible into shares are also governed by articles L. 228-91 et seq. of the French Commercial Code.

II. Main advantages and risks of the bonds convertible into shares

• From the point of view of the issuing company

(i) Main advantages

The issuance of convertible bonds allows the issuing company to reduce its financing costs: the interest rate of convertible bonds is typically lower than for non-convertible bonds because the value of the conversion option is deducted from the amount of the interests due.

The company can also expect to strengthen its equity in case of conversion of the convertible bonds.

(ii) Main risks

If the convertible bonds are not converted, the issuing company will have to repay the bonds (the nominal amount of the bonds as well as the possible non-conversion premium if it is provided for in the issuance contract) and have the necessary funds to do so.

• From the point of view of the holders

(i) Main advantages

The bond portion of the bonds convertible into shares offers the assurance to its holders to receive a guaranteed remuneration composed of the loan interests and the repayment of the nominal amount of the bonds.

The possible conversion of the convertible bonds offers the possibility of benefiting from the increase in value of the company as from the date of issue of the convertible bonds: by exercising the conversion of the bonds into shares, the holders become shareholders of the company and will be able to benefit from a capital gain in the event of sale of the said shares.

In other words, the holders will have an interest in converting if the value of the shares to which the bonds give right become higher than the nominal value of the bonds.

(ii) Main risks

The main risk for the convertible bondholders is the risk of default of the issuing company.

Once converted into shares, holders are exposed to a capital loss as well as illiquidity in the case of an non-public issuer.

Another point of attention for convertible bonds subscribers: in non-public companies, the transfer of securities giving access to the capital may be subject to the approval of the company if an approval procedure limiting the transfer of securities is provided for in the articles of association (article L. 228-23 of the French Commercial Code).

III. Main legal steps of the issue of bonds convertible into shares

All joint stock companies may issue convertible bonds (article L. 228-91 of the French Commercial Code).

• Possible review of the value of the assets and liabilities of the issuing company

In order to protect the shareholders and to allow them to vote the issuance of the bonds in full knowledge of the financial health of the company, article L. 228-39 of the French Commercial Code requires the issuing company whose balance sheets for the first two fiscal years have not been approved by its shareholders to appoint an auditor in charge of reviewing the value of the assets and liabilities of the company (or that the bonds be guaranteed by a company that has drawn up two balance sheets duly approved by its shareholders).

• Decision to issue the convertible bonds

The issuance of convertible bonds must be authorized by the shareholders’ meeting, which decides based on the report of the Board of Directors (or the Management Board or the Président, as the case may be) and on the special report of the statutory auditor, if any (article L. 228-92 of the French Commercial Code). The issuance of convertible bonds may be made with maintenance or cancellation of the preferential subscription right (droit préférentiel de souscription (DPS)) of the shareholders to these securities.

The decision to issue convertible bonds entails the waiver by the shareholders of their preferential subscription right to the shares issued in the event of conversion of the convertible bonds (article L. 225-132 of the French Commercial Code).

Particular point of attention: in companies which do not have a statutory auditor, in case of cancellation of the preferential subscription right, in order to reserve the issuance of convertible bonds to one or more persons or categories of persons meeting certain characteristics, the combined reading of articles L. 228-92, L. 225-135 and L. 225-138 of the French Commercial Code requires that the company appoints an ad hoc auditor with the special task of drawing up a report on the issuance price or on the conditions of determination of this price. In practice, this appointment will have to be made prior to the general meeting deciding on the issue of convertible bonds with cancellation of the preferential subscription right, so that the shareholders have the report available when they vote on the issuance.

• Issuance contract of the convertible bonds

The terms and conditions of the convertible bonds are governed by the issuance contract entered into between the holders and the issuing company. Particular attention should be paid to the following main terms of the issuance contract: amount of the issue, issue price and par value per convertible bond, duration of the loan, interest (rate, interest period, possible late interest and capitalized interest), conversion condition and ratio, cases of early redemption, cases of voluntary early repayment, organization of a group of holders (masse) and protection of the holders.

• Possible additional report to the next general meeting

In the event of the use by the Board of Directors (or the Management Board or the Président, as the case may be) of a delegation of authority granted by the shareholders’ meeting to determine the final terms and conditions of the issuance of the convertible bonds, the Board of Directors, as well as the statutory auditor, if any, must each prepare a report on the final terms and conditions of the transaction, which must be presented to the next shareholders’ meeting (article L. 225-135 of the French Commercial Code).

Our team is at your disposal to assist you in the issuance of bonds convertible into shares or any other securities giving access to the capital.